How the German Banks can win the Platform War against Amazon and Co.

For many years now German Banks provide on a voluntary base Open APIs. Open APIs have never really been a threat nor a benefit for the banks.

Usually the customer and some smaller software companies gained from the value adding customer services. This is the reason why the banks usually never changed this model although it did cost a lot and didn’t contribute neither to revenues nor to earnings.

But times are changing. Soon Open Banking APIs aren’t voluntary anymore. And 3rd Party Providers can really benefit from these like they are starting doing today already.

Open APIs already steal customers and revenue

Think of ‘Kontowechselservice’, ‘Sofortüberweisung’, ‘Check24’, Multibanking of Deutsche Bank and many others etc. This is just the beginning. Today the use of FinTS operates somehow in a grey zone, but as soon as PSD2 is available things will change dramatically I assume.

But this is just the risk side, there is a huge chance side as well.

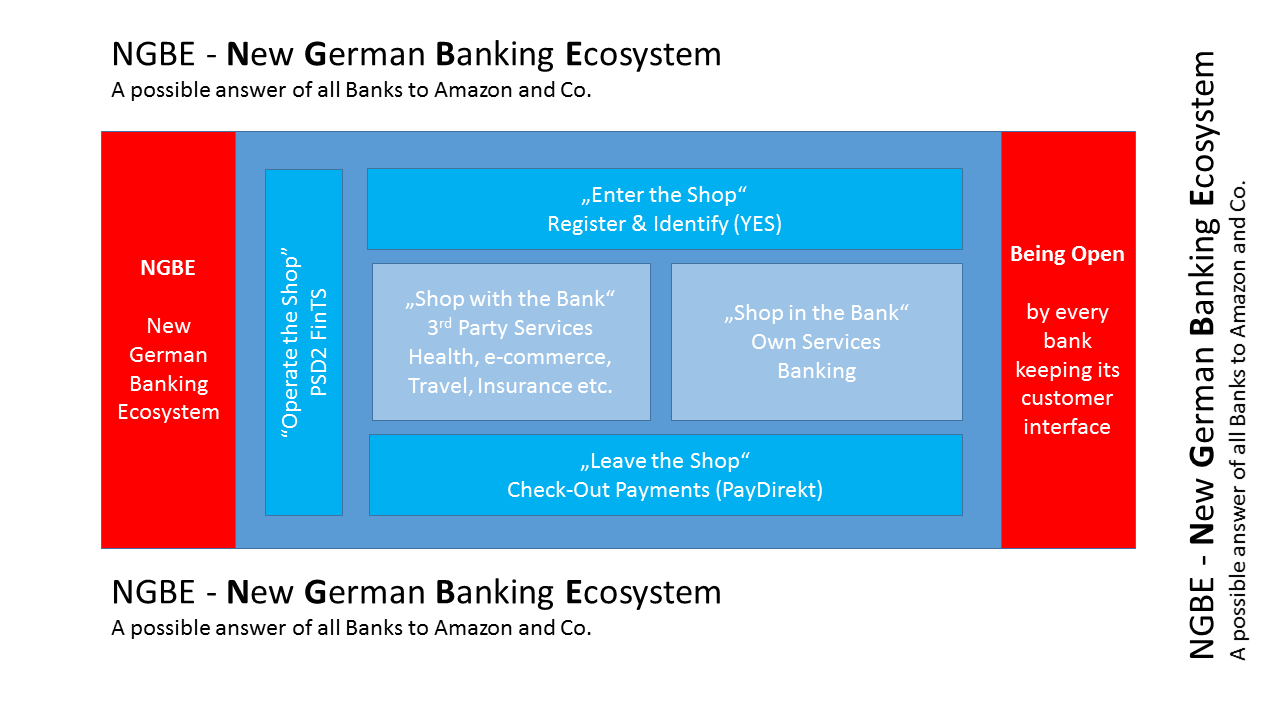

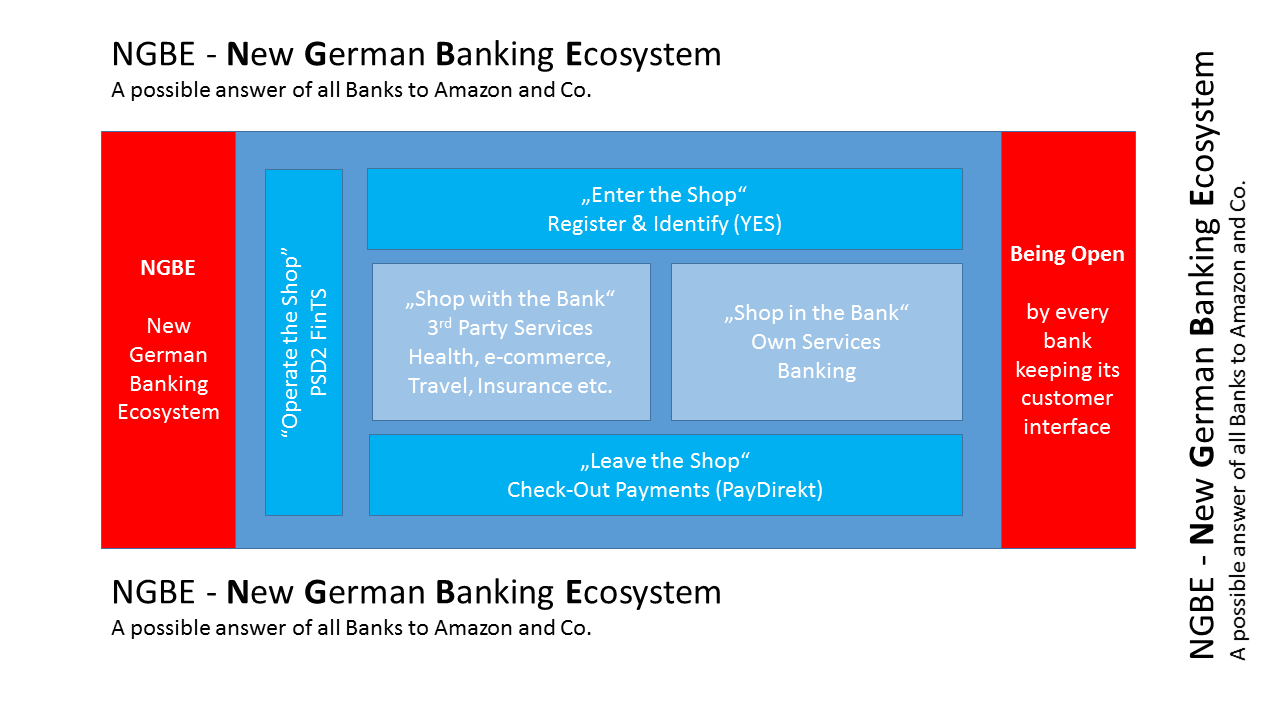

We all, as banks, shoud join forces and use these existing, coming and planed Open APIs and create a virtual Open API based banking ecosystem like the one detailed here on the One Pager:

NGBE – New German Banking Ecosystem

We need ALL or MOST of banks as we need to confirm to the ONE way to

enter the shop and on the ONE

way to leave it.

When the customer is within the shop diversity is good and will work, I’m sure, but the customer will never understand why he needs many keys.

With technologies like PSD2, PayDirekt, but also with YES (or a comparable Banking ID standard) we have all the means in our hand to letting every bank keeping the customer interface, but by preventing Amazon, Facebook, Google and all the others from ‘stealing’ the customer interface and finally the customer itself.

The customer will enter the shop with the bank, will leave the shop with the bank, can shop in the bank or with the help of the bank, but the bank is here and everywhere for trust and security.

And for services!

And of course for the customer!