What is a True Open Insurance API

Another hype topic besides platforms and ecosystems are Open APIs.

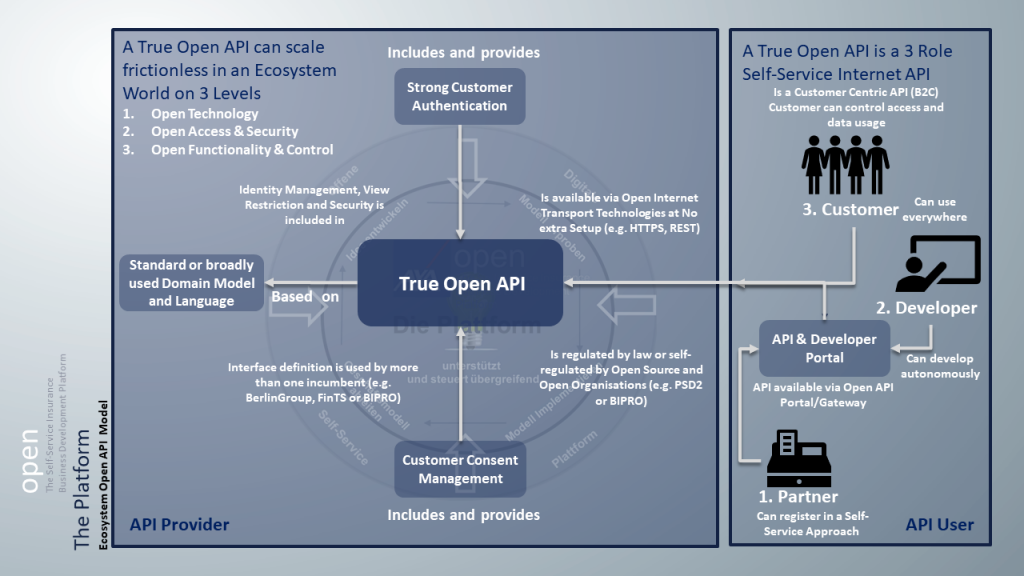

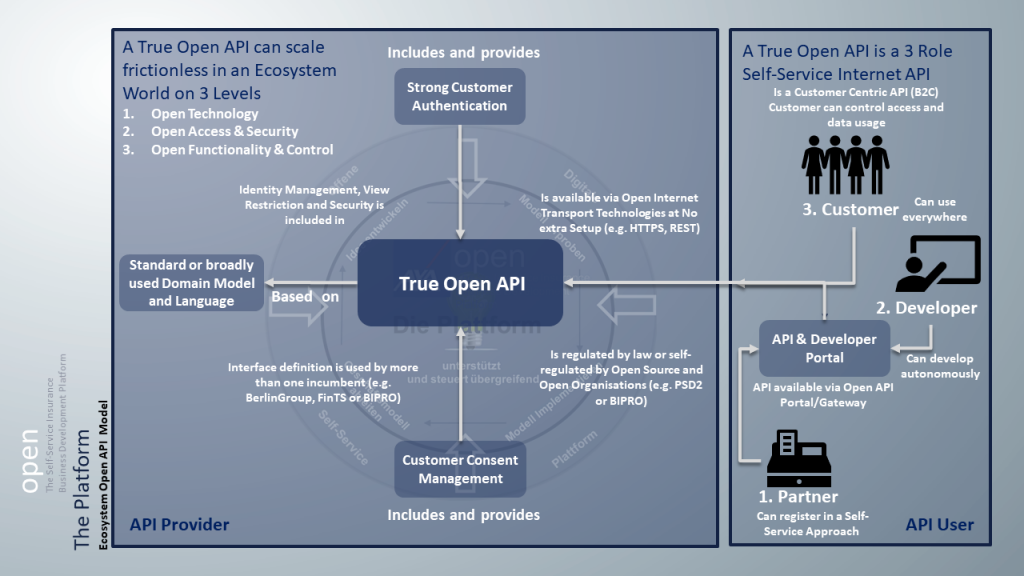

Open APIs are the DNA for a friction-less scale on the supplier and demand side within an ecosystem.

But not every API is in my eyes a True Open API. While banks, as finance forerunners, especially in Germany in the past and long before PSD2, developed or are currently developing Open APIs I don’t see this trend yet within the Insurance space.

Only because an API is technically accessible and can be accessed via Internet standards it’s not fully open or a

True Open API.

And if an Insurance API is not a True Open API the API won’t scale on a platform as best as possible.

How to create an Open API?

To become an Open API for Insurance

the Customer has to ‘sit in the Driver Seat’ and control the API like he can within banking in 2019 (B2C API).

The Insurance API must

include everything necessary to be leveraged seamlessly. The partner shouldn’t need to implement Identity management, security or validations etc. in order to use the API properly and securely.

The partner must be able to integrate the API in a Self-Service approach and the

developer should be able to work autonomously.

At a highest level of True Open Insurance APIs the partner should be able to

use the same API definition not only for one incumbent.

Last but not least the API should be governed and regulated (in some form) in order to operate in a stable, transparent, reliable and

by all parties broadly accepted environment.

To become an Open API for Insurance the Customer has to ‘sit in the Driver Seat’ and control the API like he can within banking in 2019 (B2C API).

The Insurance API must include everything necessary to be leveraged seamlessly. The partner shouldn’t need to implement Identity management, security or validations etc. in order to use the API properly and securely.

The partner must be able to integrate the API in a Self-Service approach and the developer should be able to work autonomously.

At a highest level of True Open Insurance APIs the partner should be able to use the same API definition not only for one incumbent.

Last but not least the API should be governed and regulated (in some form) in order to operate in a stable, transparent, reliable and by all parties broadly accepted environment.

To become an Open API for Insurance the Customer has to ‘sit in the Driver Seat’ and control the API like he can within banking in 2019 (B2C API).

The Insurance API must include everything necessary to be leveraged seamlessly. The partner shouldn’t need to implement Identity management, security or validations etc. in order to use the API properly and securely.

The partner must be able to integrate the API in a Self-Service approach and the developer should be able to work autonomously.

At a highest level of True Open Insurance APIs the partner should be able to use the same API definition not only for one incumbent.

Last but not least the API should be governed and regulated (in some form) in order to operate in a stable, transparent, reliable and by all parties broadly accepted environment.