ExcecInsurtech 2018 – In a Nutshell

It was a pity that I couldn’t attend longer the brillant organized and inspiring

ExecInsurtech 2018.

But even with only the few bits I took with me I predict 2019 will be the year of

PSD2 Insurance.

I saw a lot of interesting solutions and ideas. On a high level these could be sorted into one of these three categories:

- PSD2-Aggregation – Creating Multi-Insurance- and Account-Views with the help of PSD2

- PSD2-Contract- and Account–Management – Comparing and offering Insurance alternatives with the help of PSD2 and KI

- PSD2-Advisor – Full-fledged full-automated Robo Insurance Advisor with the help of customer account- and transaction-information and KI

I am very curious, if these new technical and business capabilities will be accepted by the market and the customers. And if and how these will then influence traditional carrier relationships finally.

Besides I also discussed Open Insurance compared to and in the context of PSD2. With the help of Friendsurance’s Sebastian we got a first insight into and impressions of how PSD2 insurance can work.

Masterclass PSD2 and OpenInsurance

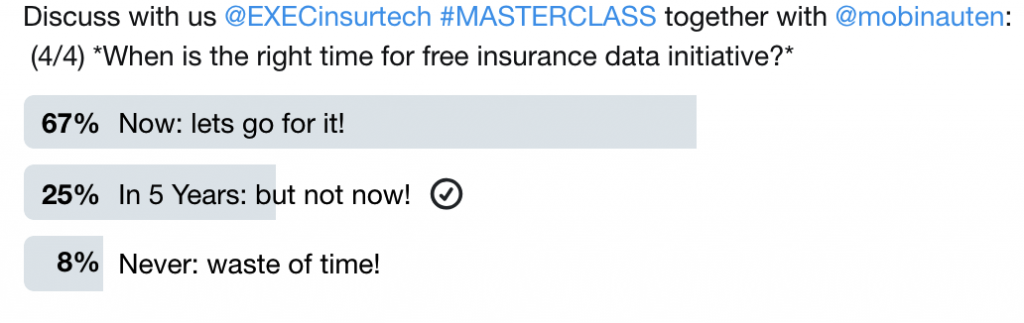

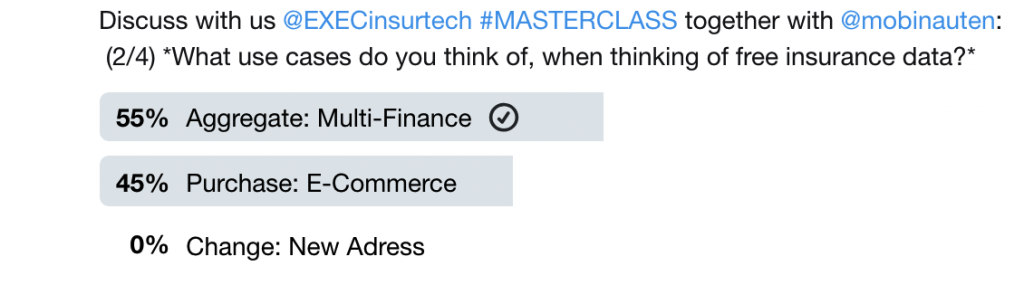

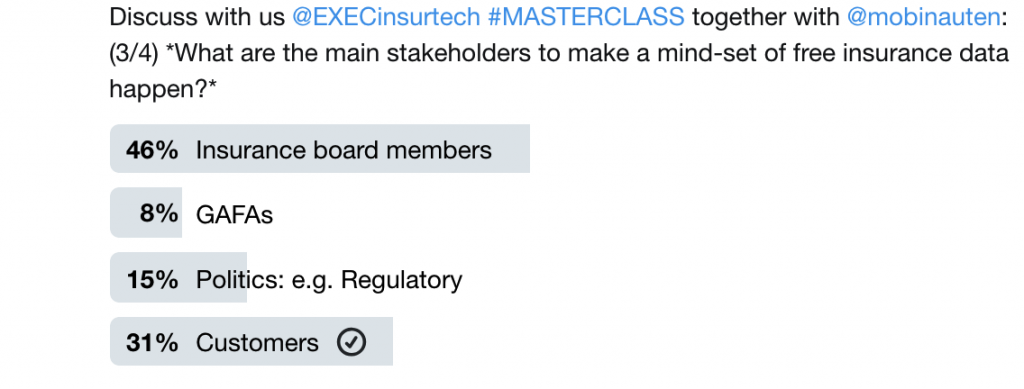

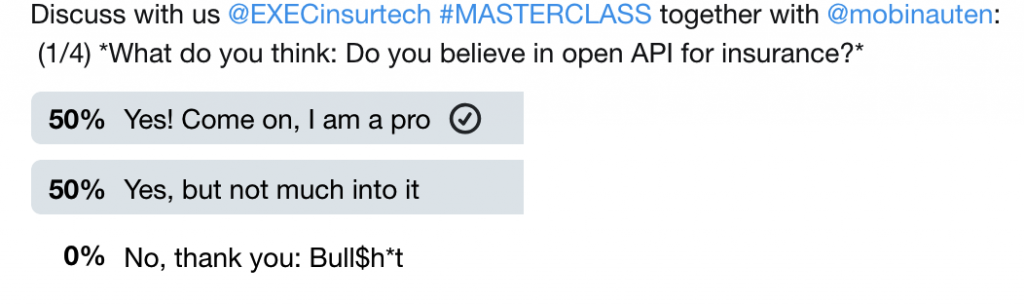

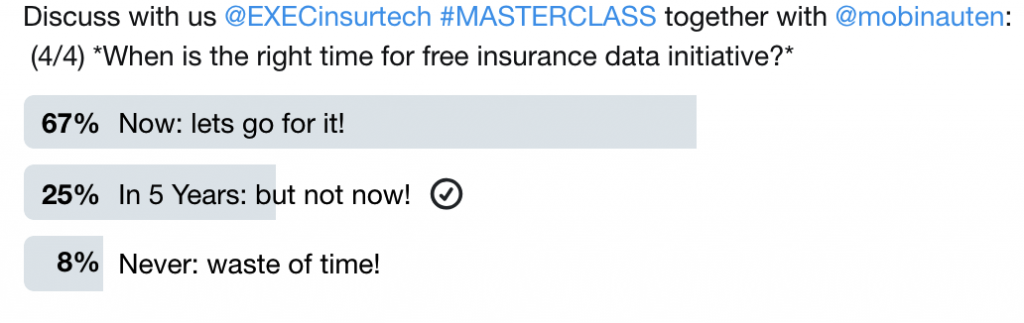

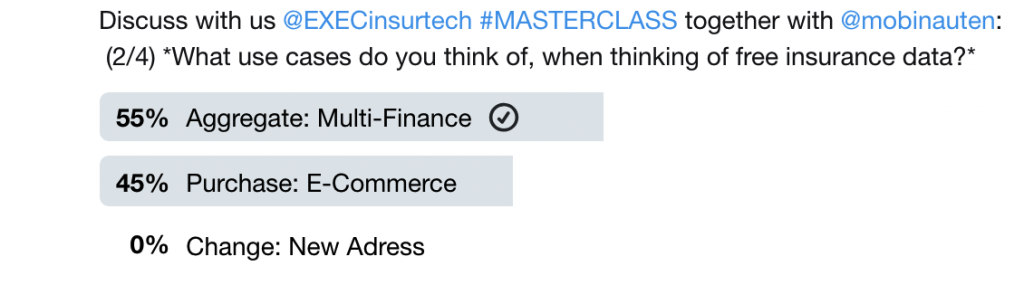

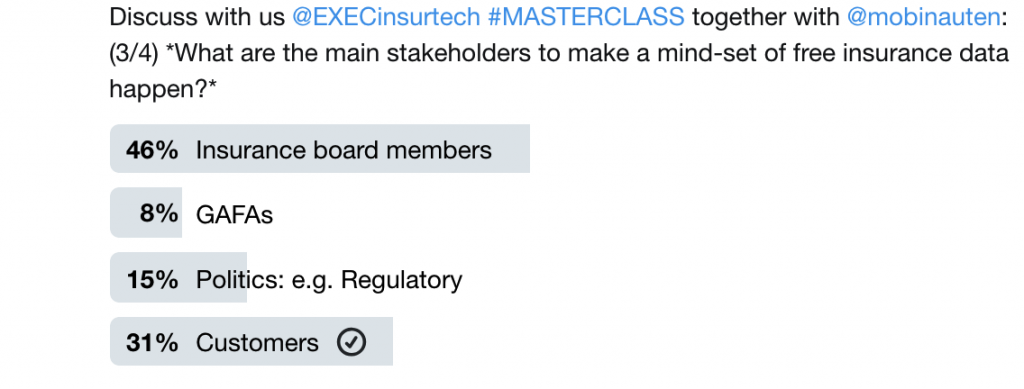

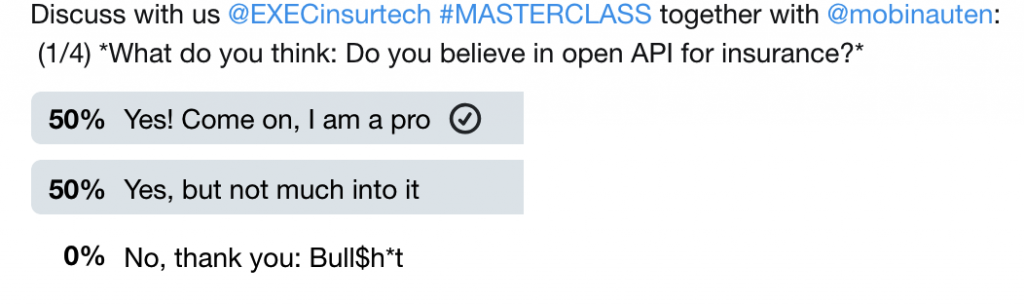

Together with our classroom participants we discussed, if PSD2 derived Open APIs could also be a trend for insurance. After the exchange of some controversial views we answered the following polls:

These polls and our classroom results are far from being representative.

But with the solutions I saw at ExecInsurtech, the feedback I received and the discussions I led I believe I see a trend.

And an interesting question remained in the room:

How should/could the existing and traditional world handle and react to it?

I saw a lot of interesting solutions and ideas. On a high level these could be sorted into one of these three categories:

I saw a lot of interesting solutions and ideas. On a high level these could be sorted into one of these three categories:

These polls and our classroom results are far from being representative.

But with the solutions I saw at ExecInsurtech, the feedback I received and the discussions I led I believe I see a trend.

And an interesting question remained in the room:

How should/could the existing and traditional world handle and react to it?

These polls and our classroom results are far from being representative.

But with the solutions I saw at ExecInsurtech, the feedback I received and the discussions I led I believe I see a trend.

And an interesting question remained in the room:

How should/could the existing and traditional world handle and react to it?